By Elaine, Gersi, Joris and Leonoor

The Asylum Crisis

Granted with a new mandate following the adoption of Regulation (EU) 2021/2303 on 19 January 2022, the European Union Agency for Asylum (EUAA) has transitioned into a full-fledged agency. Its goal is to improve the functioning of the Common European Asylum System (CEAS). As the successor of the European Asylum Support Office (EASO), the EUAA is tasked with upholding and promoting respect for fundamental rights within the European Union’s (EU) asylum system.

Fundamental rights are particularly relevant in the CEAS. This is especially so, given that migrants and asylum seekers often find themselves in a vulnerable position. This can be due to for example their lack of resources, and poor living and material conditions. Following the mass influx of refugees on the EU’s shores leading to the asylum crisis of 2015, a reform of the CEAS was needed to create ‘a more humane, fair, and efficient European asylum policy’. In light of this, the EUAA has implemented a more robust fundamental rights strategy. This strategy contains several safeguards.

One of these safeguards is the new Fundamental Rights Officer (FRO). The FRO portraits the enforcement of, and adherence to fundamental rights within the EUAA. In this blog post it will be argued that, as follows from the 2022 Ombudsman initiative, the FRO adds value to the workings of the EUAA. This is because the FRO aids the Agency in several ways within the field of fundamental rights.

François Deleu: the man for the job

Following the new fundamental rights strategy, Article 49 Regulation 2021/2303 requires the Management Board of the Agency to install a FRO. The FRO is appointed to design a new Fundamental Right Strategy, manage a new complaints mechanism, and contribute to the Agency’s Monitoring Mechanism. Appointed in May 2023, François Deleu is the first to take on this task.

“I will develop and uphold a robust Fundament Rights Strategy that will build on what is already in place, ensuring that the respect for fundamental rights is central to all the Agency’s growing activities” ~ François Deleu

While the FRO works independently, Deleu collaborates with the Agency’s Consultative Forum of Civil Society Organisation to create the new Fundamental Right Strategy. The Consultative Forum has an advisory function: it is established to exchange information with relevant civil society organisations and bodies operating in the field of asylum. This includes the European Union Agency for Fundamental Rights and the European Border and Coast Guard Agency (Article 50 Regulation 2021/2303). Together, the FRO and Consultative Forum aim to ensure that the Fundamental Right Strategy is properly reflected in the Agency’s workings. They also work towards preventing breaches of the Charter of Fundamental Rights of the European Union (Charter).

The FRO is designed as a response to the 2019 Ombudsman decision on maladministration in the practice of the EASO. The FRO therefore manages a complaints mechanism created for individuals who may have suffered a violation of their fundamental rights by an expert employed by the EUAA. The FRO moreover contributes to the Agency’s Monitoring Mechanism of Member States’ asylum systems. The FRO does so by ensuring that this mechanism takes fundamental rights concerns into account.

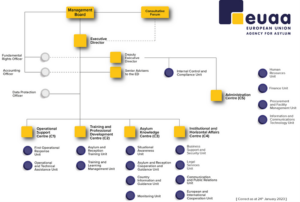

Organisational structure of the EUAA

A Slow Start…

Following the 2021 revamping of the EUAA framework, the European Ombudsman opened a new strategic initiative. In this initiative, the Ombudsman posed 16 questions to the Agency. This included questions on how the EUAA complies with its fundamental rights obligations and how it ensures accountability for potential violations. These questions related to the renewed protection offered by the 2021 Regulation. It therefore raised attention to the FRO. What followed was a back-and-forth correspondence between the Agency and the Ombudsman.

It should be mentioned here that the Ombudsman does not issue legally binding decisions. However, its reports are valuable in assessing the Agency’s compliance with its fundamental rights obligations. This follows from its mandate of investigating ‘instances of maladministration in the activities of the Union institutions, bodies, offices or agencies’ (Article 228(1) TFEU).

At the time of the investigation, Deleu had not yet been appointed. One of the questions therefore rested on when the Agency anticipated this position to become operational. In the Agency’s initial reply of 11 July 2022, it walked through the appointment procedure for the FRO. The reply highlighted that certain steps like kick-starting the selection process were taking longer than expected. This could be owed to the “extensive consultations” held with all involved stakeholders. These consultations were needed to ensure that the necessary attention to detail was afforded in the selection of candidates.

The Ombudsman later expressed disappointment in February of 2023 that the position remained vacant more than a year after the 2021 Regulation came into force. It urged the Agency to fill this position as “a matter of urgency”, because of the need to operationalise the Agency’s other fundamental rights mechanisms. In this way, the FRO can be seen as the catalyst for all EUAA fundamental rights mechanisms.

…But a Promising Future

As mentioned, the FRO position was eventually filled in 2023. At the time of writing, Deleu now holds office for nearly a year. So, what can be said for this new development?

At the end of June 2023, the Agency replied to the Ombudsman observations. In the reply, the Ombudsman was informed of this long anticipated appointment. Also, it was stated that the fundamental rights strategy was expected to be adopted in March/April 2024. At the time of writing, it can therefore be expected any day.

Additionally, the response addressed recommendations for the FRO to review all operational plans signed between the Agency and EU Member States. It highlighted that Deleu had already reviewed plans with Spain, Bulgaria and Lithuania since entering office. Here, the value of the FRO can be seen through its direct involvement in scrutinising Member State plans.

In July of 2023, the EUAA also published its Annual Report about asylum in the EU. In the Annual Report, it discusses its newly developed escalation process. This process is outlined under Article 18(6)(c) of the 2021 Regulation. It stipulates that the Agency’s Executive Director can suspend or terminate asylum support teams in a Member State that is violating fundamental rights or international protection obligations. This is done after consultation with the FRO.

An overview of the EUAA's timeline (made by the authors of this post)

A Well-Rounded Appointment

As a final note, the recruitment process’ emphasis on maintaining the FRO’s independence towards the Executive Director should be highlighted. This is important due to the weight placed on independence in the FRO’s mandate. The selection committee for the post therefore included external stakeholders, like the European Commission Directorate-General for Migration and Home affairs. So, while the position is appointed internally, individuals from outside the Agency have a say in deciding the next FRO. Based on the selection procedure, a list of candidates is sent to the Management Board, which ultimately takes the final decision. Ultimately, it is therefore an internal decision with external input.

The importance attributed to the FRO in the Ombudsman initiative has now been shown. The office’s essential role in upholding the new framework’s mechanisms is also evident. Hence, the FRO can be seen to hold great added-value for the Agency, with further-untapped potential.

ETIAS, THE ELECTRONIC TRAVEL AUTHORISATION FOR EUROPE

ETIAS, THE ELECTRONIC TRAVEL AUTHORISATION FOR EUROPE